B2C Security Deposit Platform

Client LoCation

Tallinn,

Estonia

Tech Stack

Ruby on Rails, AWS, PostgreSQL, Sidekiq, Capistrano, HTML5, CSS3, ES6, Bootstrap, third-party APIs

Team

2 Backend Developers

1 QA Engineers

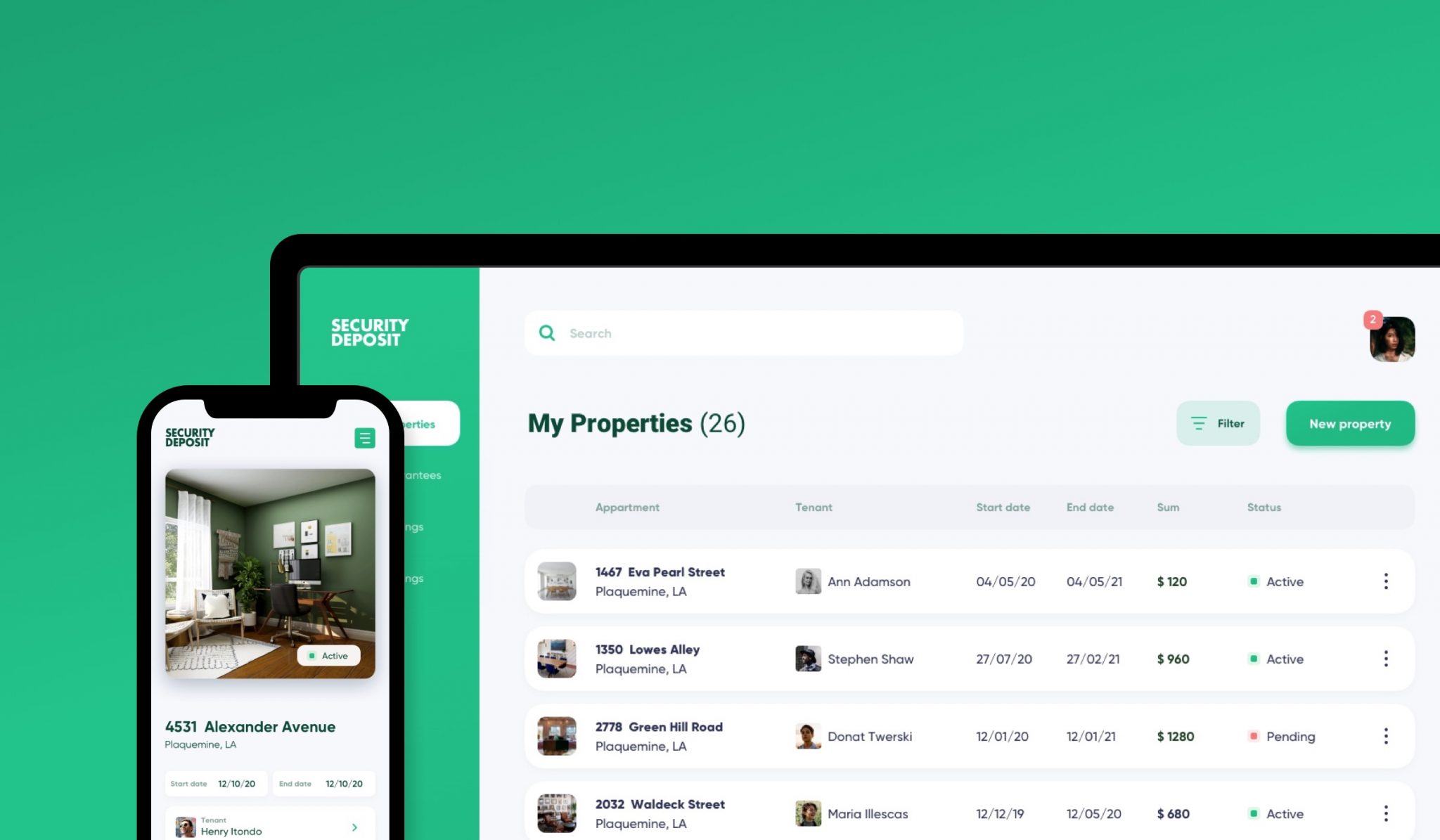

AwesomeHive team helps an international fintech company develop an innovative approach in B2C deposit guarantee operations for the European market.

Client

Challenges

AwesomeHive’s customer faced the problem of finding an outsourced partner with profound expertise in fintech development. They stopped collaborating with the previous vendor because of the software’s quality and failure to meet deadlines. The customer understood potential financial loss, so they had to continue development as soon as possible. We easily met the customer’s requirements as our experts already have experience in financial software engineering and development. According to the initial business plan, our team took over the backlog tasks after the customer’s previous vendor and scheduled the launch date.

Working on the finance solution, Leobit’s experts had to ensure that the customer’s product aligns with the permissions needed to operate in the finance field. They successfully went through various tie-ups, meeting many standards, measures, and compliances during the development phase.

The security of data is vital to the business. High privacy and integrity of transactions or financial records with ease of use for an end-user is a principal feature. Biometric integrations, in addition to AI, bring security and user experience to a new level.

Solution &

Result

The customer’s guarantee solution is a Ruby on Rails monolith platform. Monolithic architecture and Ruby’s great ecosystem helped accelerate the development process and increase product resiliency. The application is deployed on AWS and guarantees reliable and secure storing and managing of customer data and transactions.

Throughout the development process, AwesomeHive’s experts performed multiple integrations. For instance, they conducted third-party API integration with one of the Estonian banks. It provided the customer’s platform with access to a digital banking service that evaluates the criteria when lending a consumer loan. Onfido integration combines biometric verification with Machine learning algorithms to check whether a platform user’s identity is genuine and protects all sides of agreement against forged documents. Integrations with Twilio and Smart ID electronic identity solutions provided users of the customer’s finance system with the most secure identity authentication when logging into their accounts. Smart ID also speeds up the agreement finalizing thanks to legally recognized electroniс signatures equivalent to handwritten ones.

To detect code defects and errors earlier and isolate faults, AreaHive team uses Continuous Integration practice that implies ongoing automated tests and eventually leads to development cost reduction.